tax sheltered annuity vs 403b

These retirement accounts are typically offered by. A 403 b plan.

403b Vs 401k Here S The Difference Arrest Your Debt

A 403 b plan also known as a tax-sheltered annuity plan is a retirement account available to certain employees including public school teachers and nonprofit workers.

. The UW 403 b Supplemental Retirement Program SRP formerly the UW Tax-Sheltered Annuity TSA 403 b Program allows employees to invest a portion of their income for retirement on. Nonprofits and public education institutions can establish tax-sheltered annuity plans often known as 403 b plans. They enable participants to invest pre.

How Much Do I Need to Retire. A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt. What Is a 403b Plan.

In this publication you will find information to help you do the. A 403b plan is also known as a tax-sheltered annuity or TSA plan. A 403b is also known as a tax-sheltered annuity TSA.

A 403b is an employer-sponsored retirement savings account sometimes also called a TSA tax-sheltered annuity plan. The Perfect Retirement Age. Tax Sheltered Annuity 403b Deferred Compensation 457.

These plans tend to be offered by public schools and some nonprofits. IRC 403 b Tax-Sheltered Annuity Plans. A 403 b plan sometimes called a tax-sheltered annuity plan is a type of retirement plan available to public school employees certain ministers and employees of.

Overview of the 403b Final Regulations On July 23 2007 the first comprehensive regulations in 43 years were issued published July 26 2007. Tax Sheltered Annuity 403b Deferred Compensation 457 General Description A retirement. What Is a 403b.

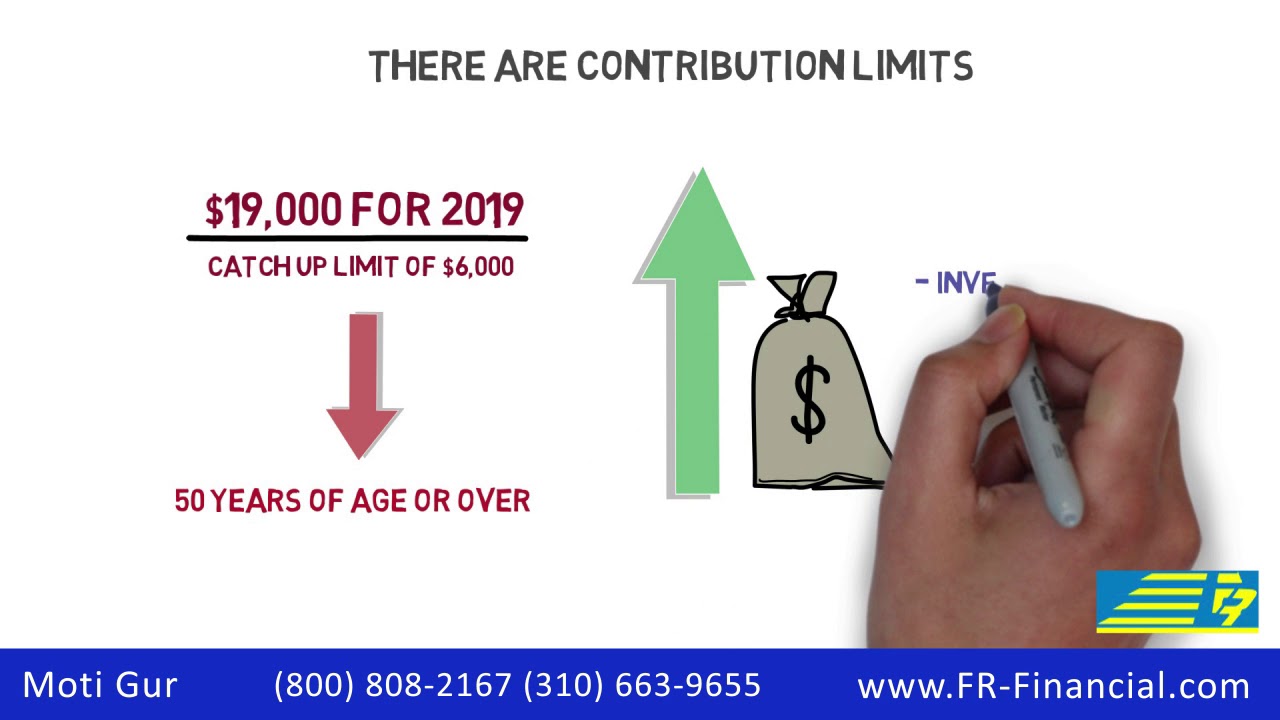

A 403b plan is also another name for a tax-sheltered annuity plan and the features of a 403b plan are comparable to those found in a 401k plan. You can contribute as little as 15 per month or as much as 100 of your eligible compensation up to 20500 for 2022 in the UTSaver TSA Traditional and Roth combined. Its like a 401k but for public and non-profit institutions rather than private companies.

According to the IRS a 403b plan or tax-sheltered annuity TSA differs from a 401k in that it can only be offered by public schools and certain tax-exempt organizations. What Are 403 b Annuities. 2022 Plan Comparison.

The regulations package reaches out beyond. This publication can help you better understand the tax rules that apply to your 403 b tax-sheltered annuity plan. Retirement Planning Menu Toggle.

The Tax Sheltered Annuity Tsa 403 B Plan Free Calculator

403 B Plan Guide To Tax Sheltered Annuity Plan For Retirement Focus On The User

Tax Sheltered Annuities What Are They And Who Are They For

:max_bytes(150000):strip_icc()/GettyImages-200018235-002-353a8428c860412489ec17b6e402786e.jpg)

Tax Sheltered Annuity Definition

Can You Roll Over A Tax Sheltered Annuity Into An Ira

403b Tax Shelter Annuity Plan Basics Youtube

403 B Vs 401 K What S The Difference How Are They The Same

Roth Ira Vs 403b Which Is Better 2022

457 Plan Vs 403 B Plan What S The Difference

403b Vs 401k Two Ways To Save For Retirement Stash Learn

What Is A Tax Sheltered Annuity Due

What Is A 403 B Is A Tax Sheltered Annuity A Good Idea

:max_bytes(150000):strip_icc()/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)

Tax Sheltered Annuity Definition

403b Vs Roth Ira Which Retirement Plan Suits You The Best Wealth Nation

The Benefits Of A 403 B Retirement Plan Sdg Accountants

401 K Vs 403 B Blog Post Durham Nc Financial Planning For Young Professionals With Student Loans Or Equity Compensation